Retirement looms for a large number of Kiwi Baby Boomers. But as they begin to enter their golden years, fewer seniors are living in their own homes.

Instead, in the thick of an acute housing shortage, more and more older New Zealanders find themselves squeezed out into an unforgiving and unresponsive rental market. And despite the media brimming with stories about the ‘housing crisis’ and how it has closed the door on many of the younger generation’s dreams of home ownership, little attention has been paid to those at the other end of life’s scales.

Yet more attention is needed. As Ageing Well Principal Investigator Dr Kay Saville-Smith predicts, by 2040 only half of all Kiwis over 65 years will own their own home. That’s a staggering forecast, given that in 2001 the figure was 82 per cent. In fact, New Zealand once boasted some of the highest rates of home ownership in the western world; now, owner-occupation rates are falling rapidly to levels that prevailed in the 1930s.

The decline in home ownership is just part of the problem. Access to affordable, suitably designed accommodation is another. Pressure to supply affordable housing to seniors has been bubbling under the surface since the 1990s. Historically, social housing was delivered to New Zealanders in partnership, with central government focusing on younger families, and local councils looking after seniors.

Yet, as Dr Saville-Smith observed, “In the 90s, the old housing system was dismantled and since then no government has really stood back and looked at how the whole system works.” The majority of accommodation available to older renters is provided by a private rental market. Government largely halted capital finance for social housing to councils in 1991, and since then, the stock of council-owned public housing has declined rapidly.

And that’s the crux of this looming crisis: as the decline in suitable housing stock continues, demand from older people for rental homes is increasing, and homelessness among this group is increasing more rapidly than for other age groups.

Housing in Aotearoa

Much of the housing available in the rental market is unsuitable for older people, and most houses are not normally built incorporating the principles of universal design (e.g. doorways wide enough for wheelchairs). Older renters may also face rent increases and uncertainty of tenure. And that’s the crux of this looming crisis: as the decline in suitable housing stock continues, demand from older people for rental homes is increasing, and homelessness among this group is increasing more rapidly than for other age groups.

As the focus of her Ageing Well research, Dr SavilleSmith’s team explored several urgent questions relating to these problems:

How will this rising reliance on the rental market impact on older people into the future?

Will renting improve or hinder older people’s wellbeing and independence?

Will renting alleviate or exacerbate cognitive and physical impairments?

And what impact, if any, will renting have on older New Zealanders’ personal dignity and social engagement?

Dr Saville-Smith’s research uncovered that older renters are twice as likely as homeowners to live in houses that are poorly maintained and twice as likely to suffer from health problems such as asthma, anxiety, and depression. They were also more likely to enter residential aged care rather than be supported within the community. The latter presents a significant societal risk and healthcare burden as the number of seniors in rentals rise.

Dr Saville-Smith’s research uncovered that older renters are twice as likely as homeowners to live in houses that are poorly maintained and twice as likely to suffer from health problems such as asthma, anxiety, and depression.

The research team has a term for the large diaspora of people moving from home ownership into the rental market: the “Tenure Revolution”. Rising dependence on rental housing for older people is a long-term trend that will not be changed without a significant overhaul in housing policy, Dr Saville-Smith notes. Even if changes occur, there are people currently in middle age who are destined for “rental dependence” in their later years. As a result, current short-term solutions need to focus on making the rental market more responsive to older adults’ needs.

Homeownership has long been associated with a “sense of security and of place within society”. But for the increasing number of seniors who are paying rent, financial pressures will certainly take a toll. For older renters, there will be a “superannuation shortfall’: “Our retirement incomes are designed to give older people a good standard of living, but it assumes they’re not going to be paying mortgages and not going to be paying rent,” Dr Saville-Smith said.

Whereas in the past twenty years, with property prices rising, it has been assumed that the “liquidation of older people’s housing wealth can be used to sustain their living standards.” The Tenure Revolution exposes such assumptions as now flawed.

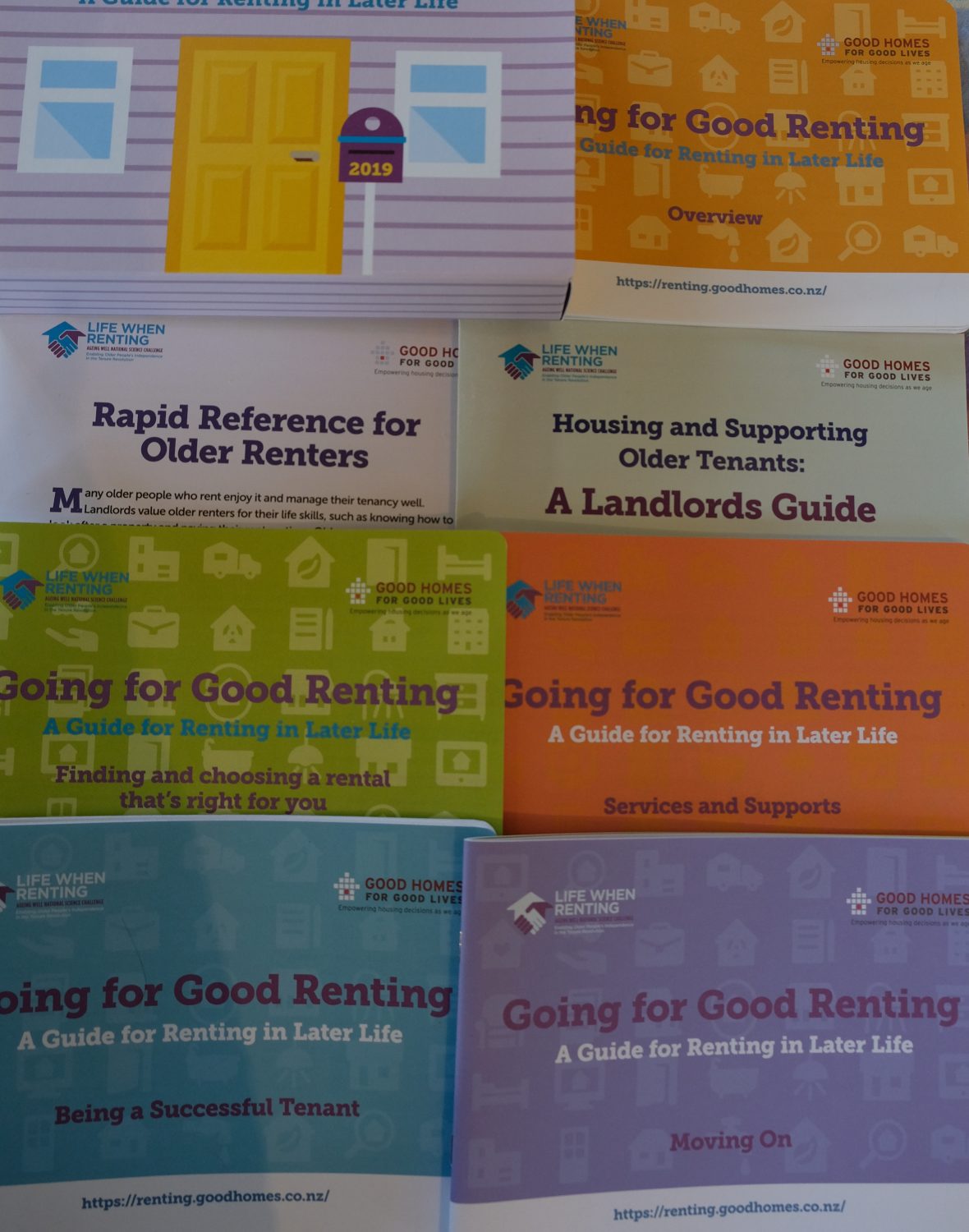

The findings of this wide-ranging research have informed a flurry of policymaking documents both locally and internationally. The Ministry of Social Development’s Better Later Life – He Oranga Kaumātua 2019-2034 addressed housing availability; Technical Advisory Services will review its interRAI Home Assessment 58 questionnaire; findings also assisted a UN Special Rapporteur to New Zealand’s review on housing and on older people’s services respectively; and contributed to the reform of the Residential Tenancies Act and the Commission For Financial Capability 2019 Review of Retirement Income: Facing the Future. This research also raised awareness among communities, landlords, property investors, and the public. Information from the research also helped develop a new tool for seniors: Life When Renting – Going for Good Rent.

Information from the research also helped develop a new tool for seniors: Life When Renting – Going for Good Rent.

Conclusion

For older people like John Hurrell, in his 70s, who lost his business and house in the 2008 Global Financial Crisis, renting is his only option. However, dealing with rising rent prices and living off superannuation has been challenging. “Because of health reasons I’ve had to stop working. So I’m faced now with trying to live on super in a rental market that’s actually going up in terms of cost,” he says.

He believes the only way to ensure that older people are properly looked after is for the Government to bring back pensioner housing. “This tsunami is just starting. I’m the beginning of the baby boomers and there’s a big crowd behind me,” he says.

Thanks to the research of Dr Saville-Smith and her team, policymakers and stakeholders now have the information required to begin to formulate solutions to this looming crisis, acutely aware that a large chunk of Boomers will require rental accommodation that is affordable, designed suitably for their needs, and which fosters their independence and wellbeing.

HELPFUL LINKS

As part of the study, the research team developed a suite of guides and toolkits. These include:

Please visit the Life When Renting website for more information.

Additionally, Ageing Well helped fund the ‘Reflections on Kaumatua, Pakeke, and Seniors Housing’, a helpful informational booklet that aims to promote the need for better housing for our growing ageing population. This was the brainchild of Ageing Well Principal Investigator, Dr Kay Saville-Smith.